Category: QSL Updates

QSL Updates

QSL Weekly Update

QSL Market Report – 22 July 2019

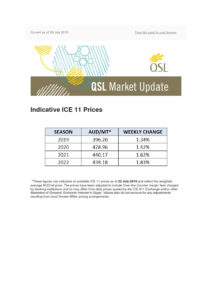

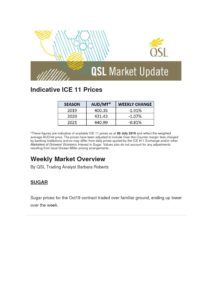

Indicative ICE 11 Prices

*These figures are indicative of available ICE 11 prices as at 22 July 2019 and reflect the weighted average AUD/mt price. The prices have been adjusted to include Over-the-Counter margin fees charged by banking institutions and so may differ from daily prices quoted by the ICE #11 Exchange and/or other Marketers of Growers’ Economic Interest in Sugar. Values also do not account for any adjustments resulting from local Grower-Miller pricing arrangements.

Weekly Market Overview

By QSL Trading Manager Matt Page

SUGAR

Last week was a precipitous week for sugar with one way action driving prices almost 80 points lower. Sugar price movements for the week can be seen in the graph below.

• What happened this week:

o A monster 800k tonne delivery for the August London Whites expiry (the White Sugar futures contract is used as the global benchmark for the pricing of physical white sugar) confirmed what many had feared after the JUL19 raw expiry – that there is indeed plenty of sugar struggling to find a home in the physical trade flows.

o Maharashtra has experienced weaker oil and grain prices, along with some much needed rain in coastal areas. This has provided a bearish backdrop.

o Brazil Real Equals (BRL) has remained firm around 3.75, although this is largely irrelevant with prices already so far below ethanol parity.

• India: The Indian Sugar Milling Association announced that it anticipates a virtual reproduction of this year’s cane/sugar subsidy framework. Although not entirely unexpected, what did surprise the market was the comment that it would prefer it applied to 8Mmt, as opposed to the 5Mmt as it was available this year. Although it is unlikely to be applied on the full volume, it will nonetheless weigh heavy on the market.

• Commitment of Traders: Bearish sentiment gave specs plenty of reason to reload their short position, with 112k lots as of Tuesday and likely closer to 120k given the ensuing price action since.

CURRENCY

A reprice of U.S. Yields saw the DXY (USD Index) down to 96.7 on Wednesday as the AUD traded towards the upper end of its three month 0.69c – 0.71c range. This is shown in the graph below.

QSL Weekly Update

QSL Market Update – 16 th July 2019

QSL Weekly Update

QSL Market Update – 8th July 2019

QSL Weekly Update

QSL Market Update – 2 July 2019

2 July 2019

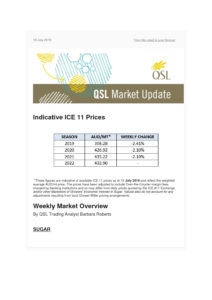

Indicative ICE 11 Prices

2019 – 406.29

2020 – 430.87

2021 – 438.08

*These figures are indicative of available ICE 11 prices as at 1 July 2019 and reflect the weighted average AUD/mt price. The prices have been adjusted to include Over-the-Counter margin fees charged by banking institutions and so may differ from daily prices quoted by the ICE #11 Exchange and/or other Marketers of Growers’ Economic Interest in Sugar. Values also do not account for any adjustments resulting from local Grower-Miller pricing arrangements.

Weekly Market Overview

By QSL Trading Analyst Barbara Roberts

SUGAR

We can officially say goodbye to July19 and welcome October19 as the new prompt contract. Expiry week was busy and volatile, with prices swinging wildly. This can be seen in the ICE 11 price chart below.

• Deliveries were reported at a near record 2 million tonnes of sugar. The biggest surprise was finding 1.1 million tonnes of Brazilian sugar delivered to the tape, when Brazil has been running the highest mix of ethanol for the past 18 months.

o Delivered to the tape?: Buyers and Sellers of ICE 11 sugar futures contracts have until the last day to close out their contract positions on the market. Any buyers/sellers that hold open positions after the final trading session are obliged under the standard terms of the futures contract to deliver or accept delivery of physical sugar and receive/pay the agreed price for the physical commodity.

• 251 mills are currently operating in Brazil. The crush rate is some 7 million tonnes of cane behind last year. Nine mills are about to start their operations over the following weeks which should close the gap.

• Rainfall just before harvest appears to have compromised the sugar content in the cane, currently 4.04% lower than last year.

• 30% of total cane production has been processed which indicates that almost 800.000 tonnes have been already channeled for ethanol production.

Crude Oil: At the G20 meeting, Russia and Saudi Arabia agreed to extend oil production cuts for another 6 to 9 months to support crude oil prices. The crude oil price is currently trading around $59 per barrel.