Category: KCGO News

The latest news from Kalamia Cane Growers and Kalagro for Members Only.

2019 National Carbon Farming Conference & Expo

2019 NATIONAL CARBON FARMING CONFERENCE & EXPO

Carbon Farmers of Australia (CFA) are hosting a national conference & expo at Albury Entertainment Centre, Albury NSW from 5-8th August 2019.

The theme of this year’s National Carbon Farming Conference & Expo is …IT’S TIME.

Time for Farmers to understand how to access the Carbon Market, time for innovations to come forward, time to stand up and shout “Farmers are the Heroes of Climate Action!”

2019 marks the 9th National Carbon Farming Conference & Expo presented by CFA.

Conference will explore and showcase the latest knowledge on:

• Carbon Farming in Australia and Internationally

• Farmer experiences in Carbon Farming

• What Carbon Farming methods are working?

• Innovation in Trading mechanisms

• Future methods

• Who buys Carbon Farming Credits and why?

• Is there a market outside of the Australian Emissions Reduction Fund?

• What is the future of this Market?

• How do I engage if I want to?

Any members interested in attending or are interested in further information please click here: https://carbonfarmingconference.com.au/

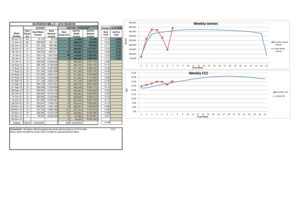

Burdekin Budget v’s Actual – Week 7

New Round of Grants – Queensland Government

QLD Government – Media Release – New round of grants to support even more regional jobs

Any members that are interested in the grants program, additional information can be found by the following link:

http://www.qrida.qld.gov.au/current-programs/rural-economic-development-grants

Wilmar Daily Loading Advice

Loading Advice – 25 July 2019

Invicta 23 501

Kalamia 12 016

Pioneer 10 803

Inkerman 12 780

TOTAL 59 100

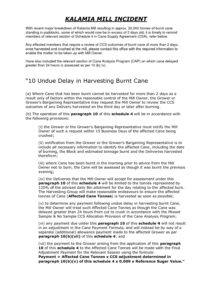

KALAMIA MILL INCIDENT

SRA Levy Register / Wilmar Growerweb Notice

SRA LEVY REGISTER GROWERWEB NOTICE

Wilmar has today posted the below notification to its GrowerWeb.

Sugar Research Australia (SRA) has decided to establish a Levy Payer Register to identify all stakeholders who pay a levy to the organisation. As a result, Wilmar, as a processor of cane, is compelled by law to provide information to SRA that is either Confidential Information pursuant to the terms of your Cane Supply Agreement, Personal Information covered by the Australian Privacy Principles or both Confidential Information and Personal Information. The purpose of this notice is to inform you that going forward, Wilmar must and will provide the following information about each grower to SRA on a monthly basis: ABN; Business Name; Phone; Suburb, State and Postcode; Cane Tonnes; and The amount of the levy. Previously, Wilmar lodged a Sugar Cane Monthly Return with the Department of Agriculture each month, on behalf of ourselves and growers and passed on each Growers’ portion of the SRA levy to the Department of Agriculture without providing specific details about individual growers attached to each payment. The change is because of SRA’s decision to establish the Levy Payer Register. The first monthly report must be received by SRA by 28 July 2019. Further information about the Levy Payer Register can be found: 1. In the SRA notice at http://www.agriculture.gov.au/ag-farm-food/levies/levy-payer-registers/notices/sra ; and 2. On the Department of Agriculture website FAQ section. If you have any questions about the new requirements, contact SRA Executive Manager, Investor Relations (call 07 3331 3329 or email [email protected]) or the Department of Agriculture (call 1800 020 619 or email [email protected] ).

Additional information can be found by clicking here.

Les Elphinstone

Manager KCGO

QSL Market Report – 22 July 2019

Indicative ICE 11 Prices

*These figures are indicative of available ICE 11 prices as at 22 July 2019 and reflect the weighted average AUD/mt price. The prices have been adjusted to include Over-the-Counter margin fees charged by banking institutions and so may differ from daily prices quoted by the ICE #11 Exchange and/or other Marketers of Growers’ Economic Interest in Sugar. Values also do not account for any adjustments resulting from local Grower-Miller pricing arrangements.

Weekly Market Overview

By QSL Trading Manager Matt Page

SUGAR

Last week was a precipitous week for sugar with one way action driving prices almost 80 points lower. Sugar price movements for the week can be seen in the graph below.

• What happened this week:

o A monster 800k tonne delivery for the August London Whites expiry (the White Sugar futures contract is used as the global benchmark for the pricing of physical white sugar) confirmed what many had feared after the JUL19 raw expiry – that there is indeed plenty of sugar struggling to find a home in the physical trade flows.

o Maharashtra has experienced weaker oil and grain prices, along with some much needed rain in coastal areas. This has provided a bearish backdrop.

o Brazil Real Equals (BRL) has remained firm around 3.75, although this is largely irrelevant with prices already so far below ethanol parity.

• India: The Indian Sugar Milling Association announced that it anticipates a virtual reproduction of this year’s cane/sugar subsidy framework. Although not entirely unexpected, what did surprise the market was the comment that it would prefer it applied to 8Mmt, as opposed to the 5Mmt as it was available this year. Although it is unlikely to be applied on the full volume, it will nonetheless weigh heavy on the market.

• Commitment of Traders: Bearish sentiment gave specs plenty of reason to reload their short position, with 112k lots as of Tuesday and likely closer to 120k given the ensuing price action since.

CURRENCY

A reprice of U.S. Yields saw the DXY (USD Index) down to 96.7 on Wednesday as the AUD traded towards the upper end of its three month 0.69c – 0.71c range. This is shown in the graph below.

BMP Programs – Survey from SRA Next Crop Program

Dear GROWERS,

As part of our SRA Next Crop 2019 program, I’m one of several farmers from our sugar industry embarking on a project to address an issue that is going to have an increasing impact across our State. In light of swelling Government legislation aimed at farming practices, we are concerned about the level of uptake of farmers adopting recognised Best Management Practice (BMP).

Our project which will dig deeper into the BMP Programs (such as Smartcane BMP, Bonsucro and Proterra) and initially seek why only a small number of growers in some areas have become accredited, and hope to improve the continued uptake of accreditation. The project may have some crossovers with other programs such a Cane Changer because we want to delve deeper into the minds of Cane Farmers to see what the impediments are, and then assist them down the path to becoming BMP accredited.

Desired outcomes:

1) Improve industry wide farm profitability

2) Underpin our social licence to operate a sustainable and environmentally responsible industry.

The above is just an extract from the Project Plan we have been working on and compiling data and we will seek to engage with industry representatives, collective groups, advisers, millers, marketers, extension officers, and agronomists throughout our industry.

To start off, we are aiming to contact several farmers from each region to gain an understanding of what the perceived impediments and advantages are when becoming a BMP accredited business.

Your assistance would be very much appreciated. Please contact me if you have any queries in relation to our project or you would like further information.

Kindest Regards

Rhonda Pirrone

0420236706

[email protected]

Any members wishing to participate in survey but would prefer to remain anonymous can forward/deliver survey to this office and KCGO will onforward it to Rhonda Pirrone via our email address.

Les Elphinstone

Manager KCGO

Wilmar Daily Loading Advice

Loading Advice – 23 July 2019

Invicta – 12 965

Kalamia –

Pioneer – 11 703

Inkerman – 11 859

TOTAL 36 527