Category: QSL Other

Other information from QSL

QSL Information Brief – 11th October 2021

Please find below a short news & information brief from QSL that you may wish to use in your communications to your members.

- Annual Report now available: QSL has released its Annual Report for the 2020/2021 financial year. Click here to read the full QSL Annual Report.

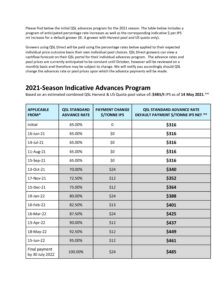

- Advance rate increase: QSL’s Standard 2021-Season Advance Rate will increase by 5% to 70% from 13 October. Click here to see the full 2021-Season Indicative Advances schedule.

- Changes to farm arrangements: Planning to buy, sell or lease a farm, or changing your existing business arrangements? QSL Direct growers undertaking such changes need to submit our “Farm Sale/Lease Information Form” to capture any associated changes to payments or their QSL account.

This form is not a contract – it simply initiates the documentation process by gathering basic information about the transaction to enable QSL to prepare the relevant Deed of Acknowledgement and/or Deed of Novation, to implement associated pricing transfers. This can be done before, during or after the transaction occurs, but ideally, before the transaction occurs.

For further information or to commence the process, please contact the QSL Direct team on 1800 870 756. Click here for the Farm Transfer Information Form

QSL Collective Update 13/09/21

QSL Information Brief – 31 August 2021

QSL Information Brief

- Grower Floor Price Contract: The 2022-Season Grower Floor Price Contract (GFPC) came close to the fill level of $450/tonne gross actual during the recent market spike. The GFPC enables growers to lock in a known return, while also receiving 50 cents in the dollar for any subsequent market moves above their achieved GFPC target. Orders can be placed for as little as 10 tonnes, up to three seasons in advance.

Click here for more information about the Grower Floor Price Contract

- Additional tonnage now available: As of 1 July 2021, QSL growers can access additional GEI tonnage to price in the 2023 and 2024 Seasons, with committed pricing levels now as follows:

| 2021 Season | 2022 Season | 2023 Season | 2024 Season |

| 70% | 70% | 70% (20% increase) | 50% (10% increase) |

To access QSL pricing, you must first have a GEI Sugar Marketing nomination in place for the season in question. See your local QSL team for details or help with the nomination process.

- Final 2020-Season Advance payment: The final QSL Advance payment for the 2020 Season will be made this week. This payment will be made as a separate transaction in addition to any 2021-Season Advance payments growers may receive that same week. The final 2020-Season payment represents a 2% increase on the June 2021 payment. The current 2021-Season Advance rate is 65%.

Click here to see the full 2021-Season Indicative Advances Program.

QSL 2021 Season Initial advances program

QSL Collective Update 04/05/21

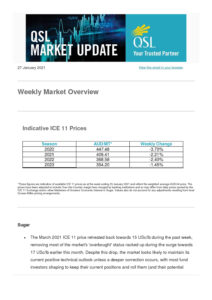

- QSL April Guaranteed Floor Pool: The April Guaranteed Floor Pool (GFP) closed for nomination on Friday 30 April. The final floor price for the April GFP is $457 AUD/tonne actual. In addition to the guaranteed floor price achieved, pool participants also receive 50% of any ICE 11 pricing above the pool’s strike price ($467 AUD/tonne actual) during the season.

- Market rally prompts pricing surge: 2021-Season prices reached new highs last week, with QSL growers achieving up to $490/tonne actual gross in the Target Price Contract (TPC) and $500/tonne actual gross in the Individual Futures Contract (IFC) against the July 2021 contract. Growers using these pricing options and the Self-Managed Harvest Contract (SMHC) are reminded they still have until next year (2022) to finish pricing their nominated 2021-Season tonnage in these products, with rolling extending the period available to achieve their orders (costs may apply). Rolling is automatic in the Target Price Contract, but is a new option for the IFC and SMHC from this season. For more information about these products and how rolling is used within them, please click the links below:

-

- Target Price Contract Overview

- Individual Futures Contract Overview

- Self-Managed Harvest Contract Overview

- QSL Grow Program: The QSL Grow Program works to promote the long-term sustainability of the Queensland sugar industry by supporting initiatives focused on protecting and increasing sustainable sugar production at a grassroots level. Click here to learn more

If members have any questions in regards to the above, please don’t hesitate to get in contact.

Russell Campbell

Grower Relationship Manager

-